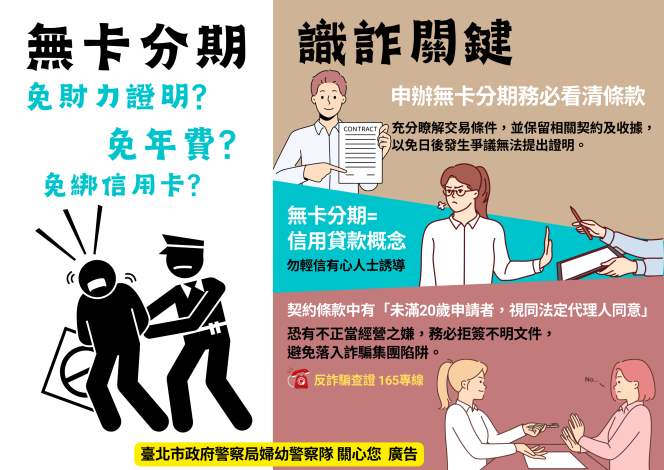

Fraud Alert: Reject Suspicious Contracts

A significant cardless installment loan fraud involving 139 university students with proceeds worthy of tens of millions came to light in October this year. On December 13, three electronics companies were indicted for aggravated fraud and organized crime under the law by the prosecutors, seeking severe punishment. The TCPD cautions that despite the measures taken against mobile communications, numerous online shopping and e-learning platforms continue offering "cardless installment" services, luring students or individuals without stable incomes with promises of no financial proof, no annual fees, or no credit card binding, etc. To tackle this issue, the TCPD's Women's and Children's Protection Division planned an awareness raising campaign at Jinou Girls High School on December 15, highlighting this case as a warning to students. Officers also underscored the importance of possessing proper sense of values, urging students not to be lured by minor monetary gains or the allure of "hassle-free burdenless shopping," leading to inattentive signing of suspicious documents. As such, young individuals may end up suffering substantial debts due to inability to terminate such fraudulent contract. Furthermore, the TCPD advises that before applying for a cardless installment, one should carefully read the terms, comprehend transaction conditions, and retain relevant contracts and receipts to prevent future disputes without proof. Given that cardless installments are, by nature, a form of credit loans, students are advised not to trust any individuals or institutions easily. Finally, contracts that include terms like "applicants under 20, deemed as having the legal representative's consent," signaled potential illegality and thus should be taken seriously. It's wise to refuse signing unclear documents to avoid falling into the trap of fraudulent syndicates. Lastly, for any inquiries or verification, call the 165 or 110 hotlines.

![Taiwan.gov.tw [ open a new window]](/images/egov.png)